ca. You can store right now and pay out after some time. With adaptable payment ideas, you can split up your acquire(s) into smaller installments that fits your spending budget as well as your timetable. Available to Shop:

Current lending fees, including key and variable fees throughout diverse terms, essential for knowing sector situations and mortgage selections.

Receipt of an application won't symbolize an approval for funding or desire charge guarantee. Not all applicants will likely be accepted for financing. Restrictions may utilize, Make contact with Charge, Inc. for present costs and To find out more.

It’s uncomplicated to be a member and begin to make use of our wonderful products and services and other member Advantages.

Level defense: Pre-acceptance may perhaps lock within an fascination amount for a particular interval, safeguarding you versus prospective charge increases When you seek out a home.

Depending on paperwork — like pay back stubs, W-2s and bank statements — that confirm your economical problem

The pre-approval letter serves as proof to sellers and real estate property agents that you've gone through a preliminary analysis by a lender and therefore are a serious customer.

A mortgage preapproval is a golden ticket to start your home-acquiring procedure. It’s a mortgage lender’s conditional arrangement to loan you a particular amount of cash depending on your economical circumstance.

If, at any time, your account has many merchandise on it, then be sure to begin to see the payment chart for that payment terms. The marketed biweekly payment will likely not implement. See Whole Cost of Possession.

Getting preapproved suggests it’s not likely you’ll fail to have funding, and it might also allow you to pay back considerably less in mortgage desire rates. There are various important actions while in the preapproval course of action, such as buying close to for lenders and collecting fiscal paperwork. For the majority of potential buyers, getting preapproved to get a mortgage is vital as it gives you a strong idea of just how much you'll be able to borrow. What's more, it reveals sellers that you simply’re seriously interested in purchasing a house.

Irrespective of if it’s a purchaser’s market place or perhaps a seller’s sector, having preapproved is important for buying a household. Listed here’s what a preapproval does:

If you’re struggling to qualify for conventional and authorities-backed loans, nonqualified mortgages may far better in shape your requirements. As an illustration, for those who don’t contain the profits verification paperwork most lenders desire to see, there's a chance you're capable of finding a non-QM lender who will validate your income applying bank statements by yourself.

Timing your ottawa pre-approved mortgage preapproval accurately is crucial to maximizing its benefits. Ideally, you need to get preapproved a number of months prior to deciding to critically start residence hunting.

Lastly, lenders choose to see a stable work record and regular income. Having said that, in the event you've just lately adjusted Work opportunities or are self-used, you’ll need to offer far more documentation to verify your earnings balance.

Yasmine Bleeth Then & Now!

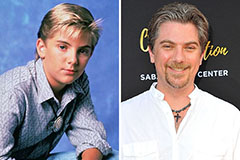

Yasmine Bleeth Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now!